Demand for EHR

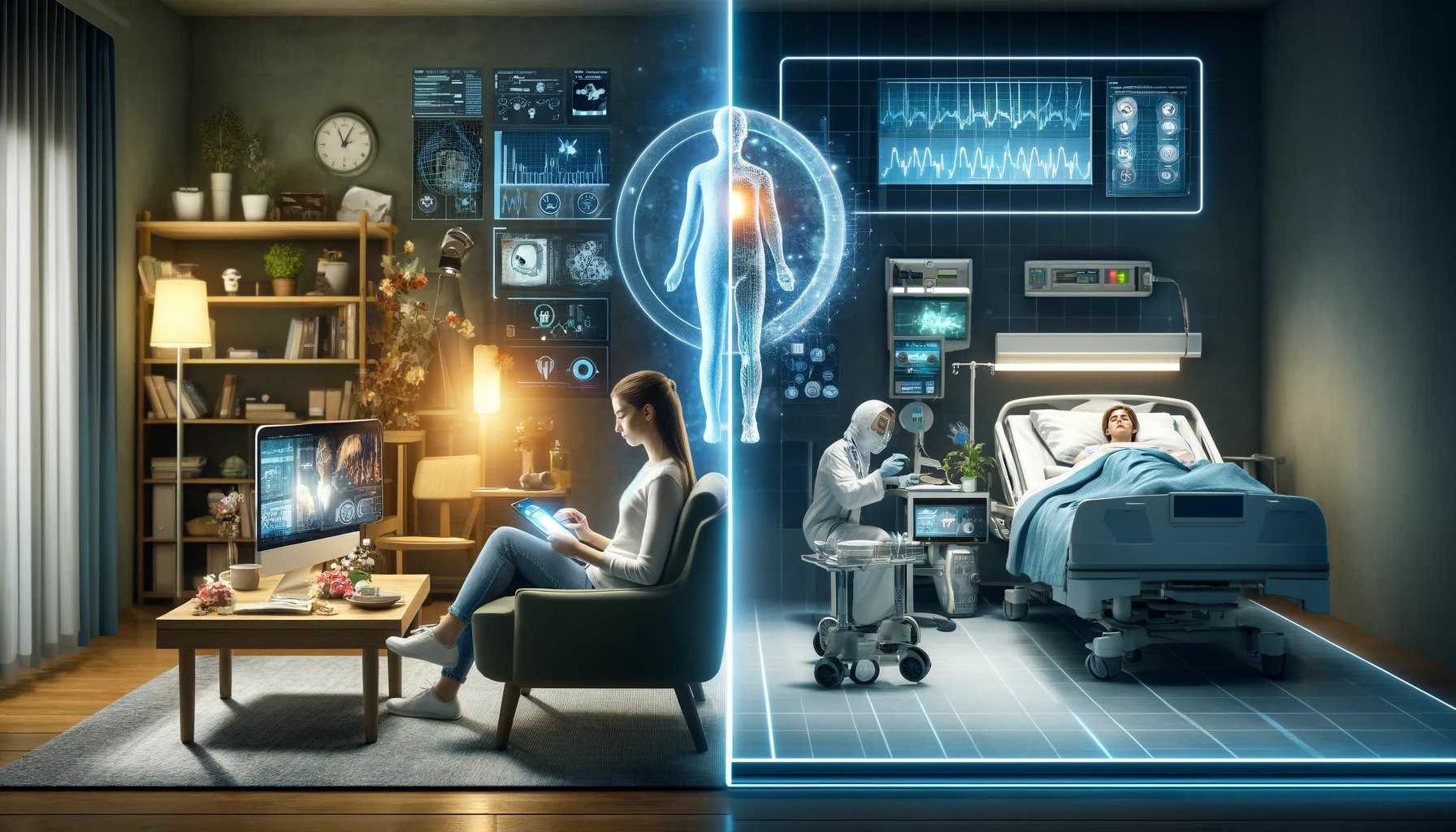

Looks like the industry, the regulators, the public, science – all demand the availability of an Electronic Health Record. We work in an industry which is highly dependent on technology – be that radiology, robots, theatres, measuring and recording of vital indicators. Patients are all using very powerful technology (on their mobile phones and/or laptops) all day, every day – leveraging the latest in cloud, artificial intelligence and mobility.

Increasingly providers (hospitals) are faced with major investments to provide the required electronic health record – redesigning clinical and business processes, selecting and implementing complex and expensive information systems, hosting these systems in the cloud (or, for now, on premises), facilitating secure exchange of data between the hospital and patients, insurers, labs, collaborating doctors, regulators and others. And all the time being required to work within the context of legislation, including recent General Data Protection Regulation (‘GDPR’).

Who pays for, who owns the data?

Traditional thinking means that providers sometimes struggle to recognise that the data is really the patient’s data – even if the provider needs to make major investments to receive basic patient data, generate and record lots of data with respect to the treatment of the patient and provide this back to the patient (and her doctor as may be required). But I think we’re not far from the idea of patients choosing providers, making data available to providers on a temporary basis, updating the data with data from the provider and then taking the data with them (potentially not leaving a copy with the provider).

So, if that is the model, how do hospitals make the investment pay?

Well, in the first instance, hospitals may not be able to play at all without the investment. Perhaps, also, we should see all of this as more of an ongoing opex cost that the traditional capex investment followed by annual support cost. This may at least provide hospitals with the opportunity to match the opex cost with the number of patients being treated.

If the model is ‘provision of affordable private healthcare’ then the spend will be justified – but it must lead to economies in many areas of operation for each hospital e.g. capture of data once, effective integration of systems (eliminate rekeying and risk of associated errors), streamlined processes in interactions with patients, improved management of supply chain, etc.

Inevitably the technology will impact patient care (before, during and after hospital admission) , interactions between consultants, GPs, patients and hospitals, commercials between payors and payees. We may also see, in the medium term, changes in the ‘relationships’/ ‘partnerships’ – between GPs and consultants, consultants and hospitals, patients and consultants/ GPs and patients and hospitals.

Achieving an ROI on EHR investment

The return on investment requires that the additional costs (be they incremental capital or operating costs) will be offset by a combination of additional revenues and reduced costs of production. This will most likely result in redeployment of some current resources – as technology driven solutions obviate the requirement for basic transcription, constant monitoring of devices, labour intensive accounting and administrative tasks.

The outlook should be very positive – any change whereby error prone and repetitive tasks can be automated should be a good thing. Likewise artificial intelligence should assist in diagnostics. Virtual reality offers opportunities for training. And oll of the changes will provide improved opportunities for collaboration and communication between patients and their doctors and hospitals. But it would be foolish tno to anticipate the likely initially negative impact on productivity and profitability when implementing these changes (many of the best people will need to be freed up to lead digital transformation type activity).