KPMG Budget 2025 briefing session

KPMG Budget 2025 Briefing

Was pleased to attend the annual KPMG budget briefing on Wednesday momning, 2nd Oct. at The Mansion House. Big turn out as usual. Excellent presenters as usual: Matt Cooper , KPMG partners , Dan O’Brien and Gillian Tett .

Matt Cooper

As per usual Matt Cooper kept the pace lively and the topic interesting. Clear that Cost of Living has been the principal issue to be addressed (not dissimilar to concerns in many countries after the long inflation run). Reminded us also of the theme of ‘politics of envy’. (I think of Margaret Thatcher who dismissed egalitarianism as “the politics of envy, the incitement of people to regard all success as if it were something discreditable”). Seems satisfied that his fellow podcaster Ivan Yates has got things right – and that an early election will now be required to leverage the giveaways in this budget.

Dan O’Brien

Dan O’Brien drew attention to Mario Draghi’s excellent recent paper addressing EU challenges: The Future of European Competitiveness . Just also watched Emmanuel Macron at Berlin on the subject of Europe’s role in a multi polar future. . DOB is satisfied that ‘inflation is done’ and lower interest rates will follow. Interesting slide showing that our pharma exports to the US now exceed out total exports to UK. Obviously were we to see any significant attempt to relocate jobs back to the US (in particular likely to be good rather than services) this would pose a threat to ongoing corporates tax receipts. For now we are on of the very few EU countries operating with a surplus. And while government expenditure has moved ahead significantly not on a par with the madness of the Celtic Tiger.

KPMG and Budget 2025

KPMG provided an excellent summary of the changes being included in Budget 2025– and a document summarising all of this.

Gillian Tett

Gillian Tett’s theme was ‘Life beyond the Balance Sheet’. Generaly economic outlook is positive – with some concerns re China. US going well and looks like achieving a ‘soft landing’. But for the accountants in the audience she reminded us that the drivers of the economy have changed and are different to what we have learned. The US ‘C-suite’ are now preoccupied with new risks: geo political, political, climate, environment, medical and AI. None of this is reflected in traditional Balance Sheet thinking. Floods are now reckoned to cost the US economy $0.5tn per annum.

GT referenced four factors for growth which we have focused on: globalisation, free market capitalisation, innovation and democracy. But these have been going in the wrong direction (think back to post WW1). She referenced growth in populism, competing memes of ‘Joy’ and ‘anger’ in US politics – although policies converging, lots of protectionism (and industrial policy) emerging – not just in the emerging economies, centralisation of power may impact innovation and autocracies ‘infecting’ democracies. All of this leading to great uncertainty – FED not clear on what policy making will look like until post election. Ireland will continue to be subject to vagaries of uncertain world – but will continue to rely on its strengths: flexibility and resilience.

Where to from here?

Difficult not to see us having an election next month – we’ve just seen a fair amount of give away in this Budget 2025. However I think what we have been hearing from Mario Draghi and Emmanual Macron should give all of us in Europe concern. We need to catch up and work more effectivly together – be that on capital for investmentin infrastructure, energy, healthcare, innovation, artificial intelligence.

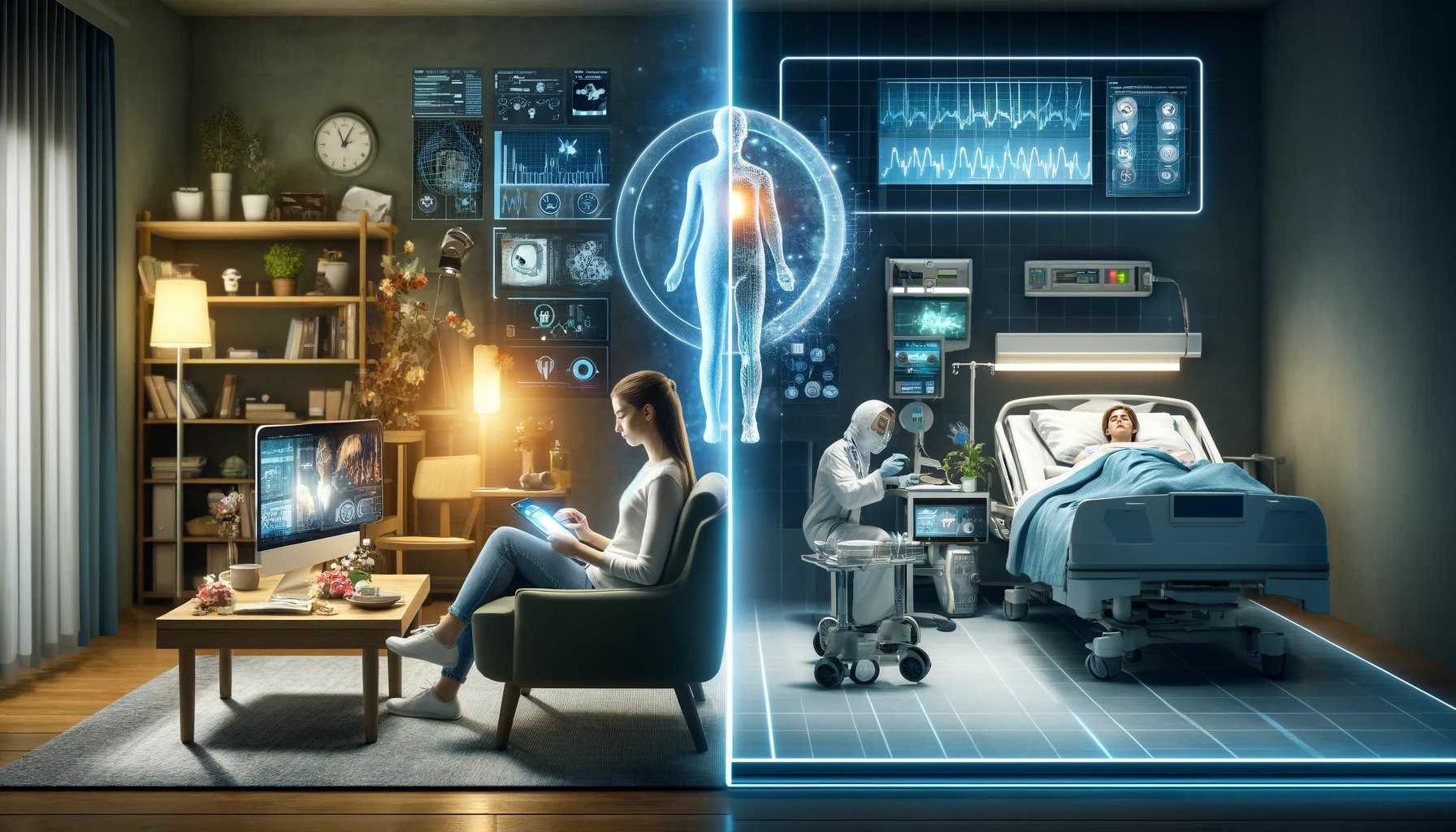

I have a particular interest in healthcare. We recently saw the publication of the Digital Health Strategic Implementation Roadmap. This aims to digitalise public health and deliver EHR across the country. But in there are major resourcing and investment challenges. Not sure the €3bn for health provides very much os what will be required to achieve this – given 50% of it is to clear up 2024 overruns. When Draghi and Macron talk about getting ahead, innovating, investing in infrastructure, are we going to get this done in healthcare?